Residential home sales totaled 1,687 in September 2022 as reported by The Real Estate Board of Greater Vancouver (REBGV). This is a 46.6% decrease from September of last year and a 9.8% decrease from the total of home sold in August of this year.

(If you are looking for the Cole's notes for this update scroll down to "THE TAKEAWAY)

“With the Bank of Canada and other central banks around the globe hiking rates in an effort to stamp out inflation, the cost to borrow funds has risen substantially over a short period,” said Andrew Lis, REBGV director, economics and data analytics. “This has resulted in a more challenging environment for borrowers looking to purchase a home, and home sales across the region have dropped accordingly.”

In September 2022 there were 4,229 newly listed detached, attached and apartment/condo units on the MLS service in Metro Vancouver. This is a 18.2% decrease from Sept 2021 and a 27.1% increase from August 2022 when there were 3,328 home newly listed in the region.

Currently the total number of homes listed on the MLS system is 9,971. This represents an 8% increase from September 2021 and a 3.2% increase from August 2022.

“With fewer homes selling and new listings continuing to come to market, inventory is beginning to accumulate, providing buyers with more selection compared to last year,” Lis said. “With more supply and less demand within this market cycle, residential home prices have edged down in the region over the last six months.”

The sales-to-active listings ratio for September 2022 sits at 16.9% for all property types combined and breaks down by type as follows:

Detached: 12.4%

Attached: 18.4%

Apartment/Condo: 20.9%

Analysts generally state that downward pressure on home prices occurs when the sales-to-active ratio moves below 12% for a sustained period, while prices of homes will often have upward pressure when it surpasses 20% over a sustained period.

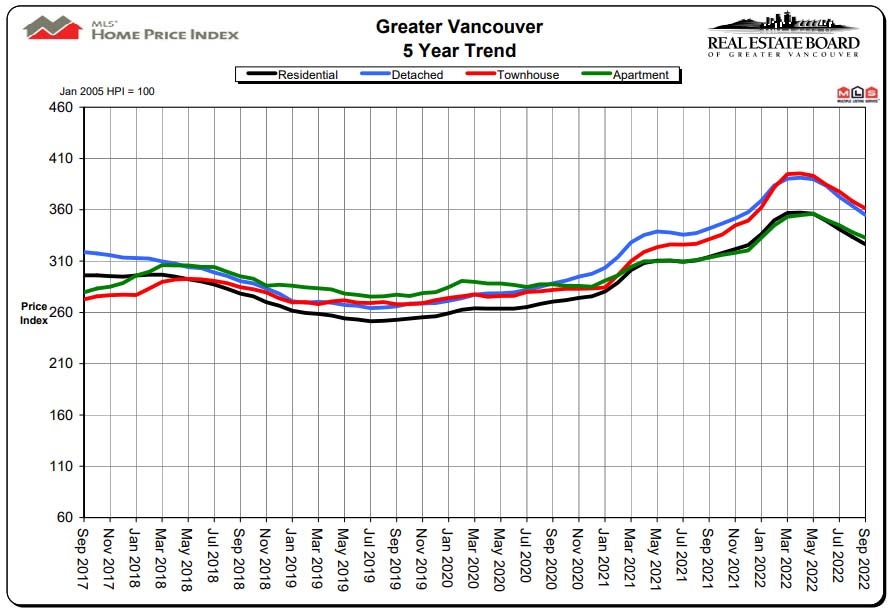

The benchmark price for all Metro Vancouver properties combined is currently at $1,155,300. This is a 3.9% increase from September of last year and a 2.1% decrease from August of 2022. Over the past 6 months there has been an 8.5% decrease in the benchmark price with a downward trend projected to carry on.

The number of detached homes sold in September 2022 reached 525. This is a 44.7% decrease from the 950 homes that were sold at the same time last year. Currently the benchmark price for a detached home in the region is $1,906,400; which is a 3.8% increase from September of last year and a 2.4% decrease from August 2022.

Attached homes reached a total of 274 sold for September 2022. This is a 52.6% decrease from September 2021. The benchmark price for an attached home is $1,048,900. This is a 9.1% increase from September 2021 and a 1.9% decrease from August of this year.

888 was the total number of apartments that were sold in September 2022. This is a 45.2% decrease in the number of homes that were sold in September 2021. The benchmark price of an apartment currently sits at $728,500, which is a 6.2% increase from September of last year and a 1.6% decrease from August of this year.

THE TAKE AWAY:

As mentioned above the steady increases to the interest rates have heavily slowed the market and reduced the buying power of any potential purchasers including pushing some out of the market altogether which has been having an increased activity in the rental market (but that is a different topic and a different update).

The Bank of Canada (BoC) is set to meet again on October 26, 2022 where it is anticipated that there will be another increase to the overnight interest rate, which will again further cool and slow the market in an attempt to decrease the inflation rate.

Does this mean “the bubble has burst”? In my opinion no as we are missing the part of the equation where people are forced to sell. This is merely a market correction from a red-hot past 2 years of activity. As with any market shift there is opportunities that can be found…

For sellers if one was planning to upsize (IE. a condo to a townhouse or detached home) doing it in a down market is the clever move even though it is not intuitive. The reasoning being based in the math workings. 10% off of $1,000,000 is larger than 10% off of $500,000. This means that when the market starts to increase again, if someone has moved up to a larger home, they will yield that larger increase from where they were.

For first-time buyers the prices are starting to have downward pressure. This means that they are going to be going down. Generally sellers are late to react as they white knuckle onto the past pricing that they used to be able to get a few months ago. Units that are coming on the market now are being priced more for today numbers and thus will be lower most likely. This slower market also gives room for negotiation and time to be able to perform more diligence such as inspections and even being able to visit a home more than once to make a proper, unrushed decision. Please do not fall into the “waiting for the market to improve” fallacy as when those words are passed around, it usually translates into “the prices are going up”.

For investors the prices are being pushed down and the mortgage rates are higher. This is having an upward pressure on rental prices. While I cannot predict the future, there is a likely-hood that the mortgage rates will decrease over time. If an investment property can be bought at a lower price with a variable mortgage, there might be an opportunity to get a lower principle and then be ahead later as you enjoy higher rent and a one day in the future lowering mortgage rate. This will result in a cash-even or cash positive investment property to hold.

So in a nutshell there is no broad stroke answer for how any market is going. YES. For some this is a tough time and that is unfortunate; but for others this might be the opportunity you have been waiting for.

If you would like a more targeted analysis for your particular area or needs and to figure out how to make this shift best benefit you, please feel free to contact me via phone at 604-522-4777 or e-mail directly at: haze@hazerealty.com or join us at our Facebook Page (www.facebook.com/HazeRealty)

(Source: https://members.rebgv.org/news/REBGV-Stats-Pkg-Sept-2022.pdf)