“August was busier than expected, and listings activity isn’t keeping up with the pace of demand. This is leaving the market under supplied.” said Keith Stewart, REBGV economist.

The MLS (Multiple Listing Service) had a total of 4,032 newly listed homes across all types (detached, attached & apartment/condo) in the August 2021. This is a 7.9% decrease from July 2021 and a 30.6% decrease from that of August 2020.

“Housing supply is the biggest factor impacting the market right now. To help relieve pressure on prices and improve peoples’ home buying options, the market needs a more abundant supply of homes for sale.” Stewart said.

The sales-to-active ratio for August 2021 is 35%. This breaks down by property type as follows:

Detached: 25.3%

Townhomes: 51.8%

Apartments: 39.2%

Analysts generally states that downward pressure on home prices occurs when the sales-to-active ratio moves below 12% for a sustained period, while prices of homes will often have upward pressure when it surpasses 20% over a sustained period.

“When assessing the market, it’s important to understand that while year-over-year price increases have reached double digits, most of the increases happened three or more months ago..." said Keith Stewart, REBGV economist.

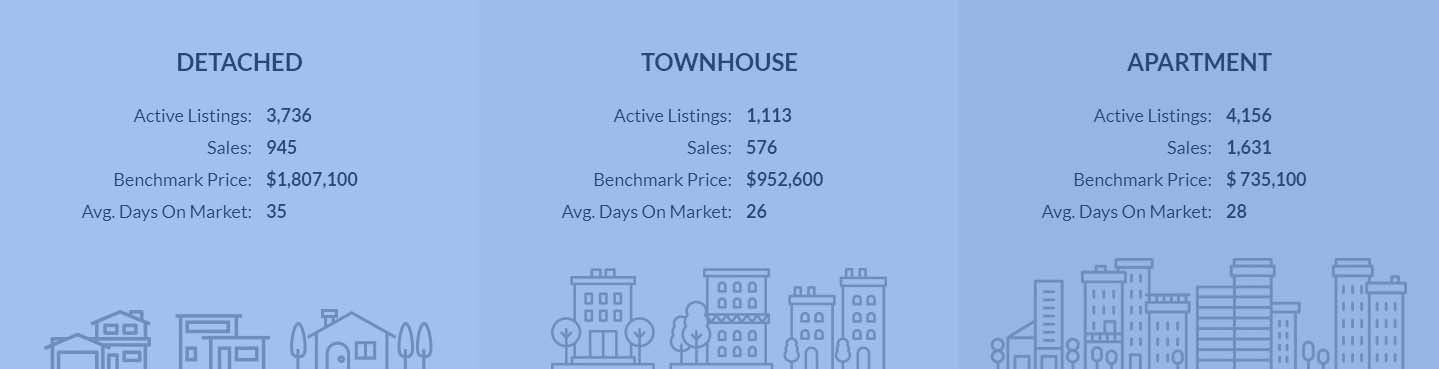

There were 945 sales of detached homes in Metro Vancouver with a benchmark price of $1,807,100 which represents a 0.3% increase from that of July 2021 and a 20.4% increase from August of last year.

Sales of attached homes reached a total of 576 and have a benchmark price of $952,000 which is also a 0.3% increase in comparison to July 2021 and a 16.5% increase from August 2020.

Apartments reached a total of 1,631 in August of 2021 with a benchmark price of $735,100. This is a 0.2% decrease from July 2021 and a 16.5% increase from August of 2020.

The Takeaway:

With prices leveling off, showing modest increase and decrease across all types of home of 0.3% and 0.2%, we can expect prices to gradually rise unless there are more properties added to the market. Typical of any election time, investors tend to stand still as they wait to see if there are any sudden changes with the government and its policies. The 2 front running parties are making claims to restrict foreign investment for 2 years; whether that comes to fruition that is another story. Simply put, if more properties do not hit the market we will see prices increase based on basic principles of supply and demand, regardless of if foreign investment is restricted or not.

If you would like a more targeted analysis for your particular area or needs, please feel free to contact me via phone at 604-522-4777 or e-mail directly at haze-hartwig@coldwellbanker.ca or join us at our Facebook Page (www.facebook.com/HazeRealty)

(Source: http://members.rebgv.org/news/REBGV-Stats-Pkg-August-2021.pdf)