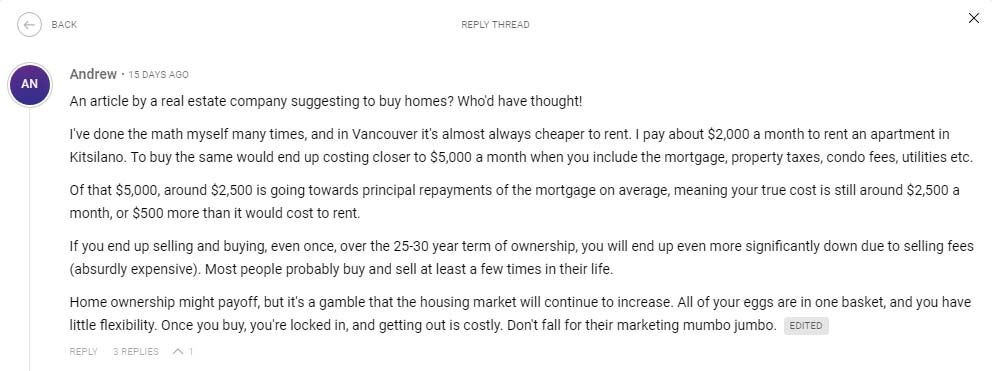

A few days ago, Royal LePage released a study that claimed renters are losing $769 more per month than homeowners (you can find it here: Buying vs Renting study: Homeowners come out in front financially in more than 90% of scenarios analyzed). Obviously, this brought out some “nay-sayers” in the comment section with zingers like, “An article by a real estate company suggesting to buy homes? Who'd have thought!” which are common to any article on real estate or renting.

I decided that we would take a closer look at these types of comments and unpack them a little, take a deeper dive than the usual ALL CAPS bickering that wastes everyone’s time on the internet.

DISCLAIMER: Yes, I am a realty advisor.

Yes, I am saying the statements below “just because I am a realtor”. That is PRECISELY why I am saying them. Learning and advising about the real estate market is my profession and what I do for a living. If you want to understand what’s wrong with your car, you don’t ask your bartender, you ask your mechanic. If you want to know about the real estate market you ask a realty advisor, not your friend’s brother’s roommate’s girlfriend who bought a condo 12 years ago in Florida.

It is also of note that I also carry a license for property management. So if you buy, rent, or both, I can negotiate in just about any residential market transaction (Purchase/Sale & Rental).

Moving on!

Above is an example of a typical response found in most comment sections, this one is from a person named “Andrew”. Let’s go ahead and unpack some of it for educational purposes:

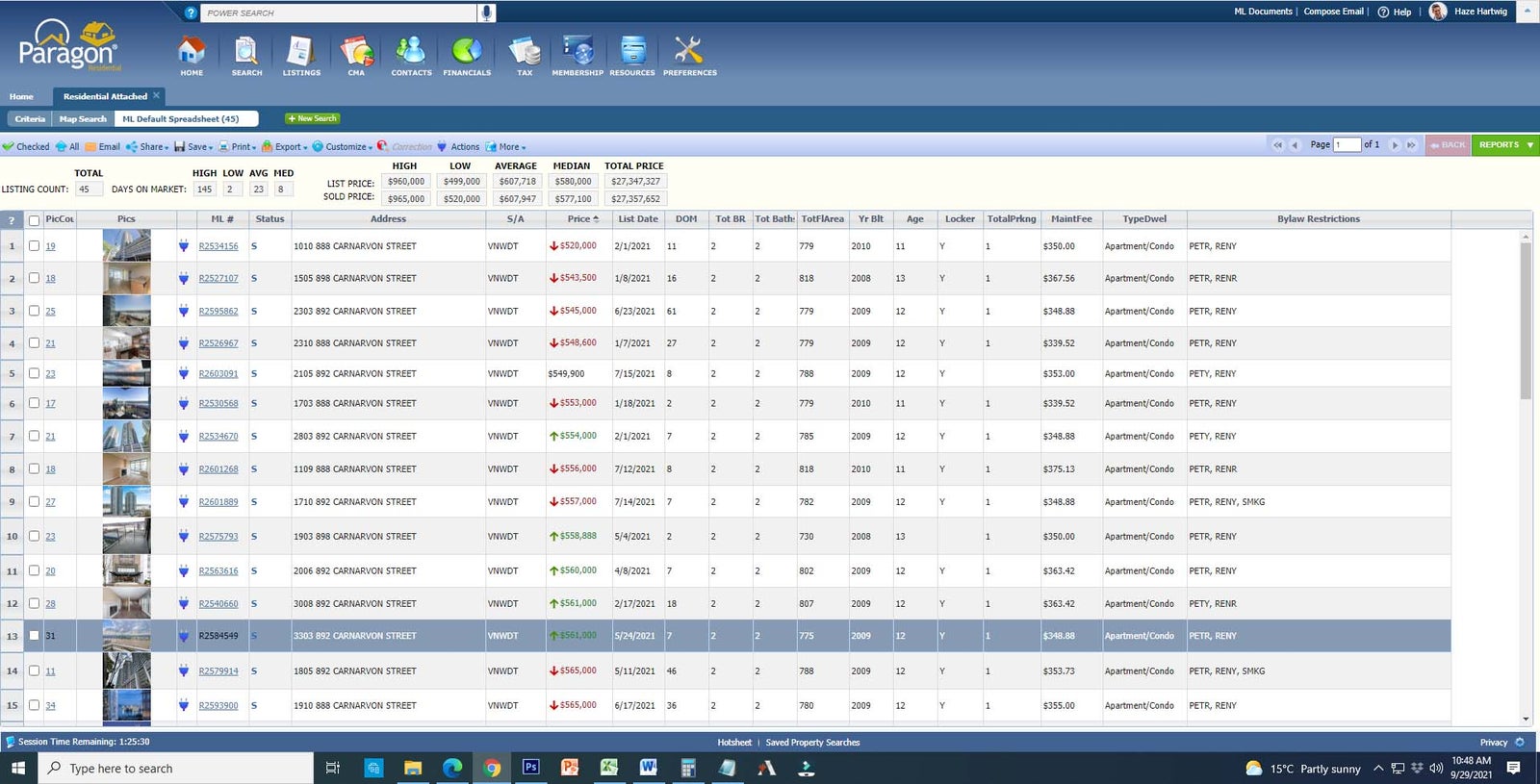

Now, Andrew’s comment is based on a very specific neighbourhood in Vancouver; Kitsilano is unique in types of homes, demographics, and yes, price. Properties out there are indeed expensive, however, it doesn’t represent the Lower Mainland as a whole. Let’s look at a property in my hometown city of New Westminster, about 30-40 mins from Vancouver, where I still live and work.

The reasoning behind using New Westminster is that I manage multiple units for landlords in 3 buildings which are all built within the same time period, by the same builder, and in the same fashion, which are #888, #892, and #898 Carnarvon St. This puts me in a unique position to speak to the data on both the sales as of late and the current market rental prices of the particular homes.

SO! Without further preamble, let’s start unpacking things and start the discussion!

Andrew’s First Point:

“An article by a real estate company suggesting to buy homes? Who’d have thought!”

Who would have thought? Apparently, they did since they wrote the article. Almost as shocking as a car company suggesting you buy a car! But to be fair, why would you read an article about buying homes written by anyone other than a real estate company? This is their industry, which means they study the market full-time. So until humans abandon buying and selling shelter, real estate companies will continue to be the authority on the ins and outs of the industry

Andrew’s Second Point:

“I've done the math myself many times, and in Vancouver it's almost always cheaper to rent. I pay about $2,000 a month to rent an apartment in Kitsilano. To buy the same would end up costing closer to $5,000 a month when you include the mortgage, property taxes, condo fees, utilities etc.

Of that $5,000, around $2,500 is going towards principal repayments of the mortgage on average, meaning your true cost is still around $2,500 a month, or $500 more than it would cost to rent.”

This quote above is actually the inspiration for this article as there are some points that are being missed here (and are missed in a lot of the “nay-sayer’s” comments on social media). Andrew is correct that about 50% (or higher) of your mortgage payment goes to your principle balance each month. So using very simple round numbers if you are paying $2400 a month, $1200 of that will end up back in your pocket if or when you choose to sell or take out some equity.

This is $1200 you will never see again when you rent.

Another aspect missed in the Rent vs. Own conversation is something everyone seeks without really knowing it; you can’t put a price on it, but in the real estate market it can be bought. That something is stability. When renting, the tenant is living in someone else’s place. This is a hard pill to swallow, but that person may eventually want to sell that place which means the tenant can be left out in the cold. And when that happens, the chances of finding a new place to rent at a similar price goes down with every year you stay in your rental.

Rent doesn’t fluctuate wildly, but it does go up over time, like clockwork. If you rent a home for 10+ years and rent increases under 3% every year, your rent is somewhat controlled. But everything around you is not, as home prices go up, so do new rental prices. When forced back into the rental market it’s quite a shock when you have to account for an extra couple hundred of dollars a month instead of the ten or twenty renters are used to with gradual increases.

When you own your own home, no one can tell you to move until YOU want to move, end of story.

Andrew is also correct that it is not ALWAYS best to buy, but in most cases it is in the long run. Let’s look at one of our case studies in New Westminster and see how the numbers look:

Subject Property: High-rise 2 Bedroom, 2 Bathroom Unit W/ Parking & Storage Locker, In-suite Laundry, built in 2009

Rent: $2000 per month (Bills such as electricity and phone have been left out as they will be present for both a home owned and one rented)

Owned: $2821 per month

Breakdown:

- Home price: $571,000

- Minimum down payment (6% Down = $34,260)

- Mortgage Rate: 2% (5 year fixed term, 25 year amortization)

- Mortgage Payment: $2,364/month

- Property tax: $1,581 per year (with $570 home owners grant) = $132/month

- Strata Fees: $325/ month

We will pause here for a moment as this is where a lot of the “nay-sayers” cry foul and say “THERE ARE NO HOMES WITH THAT DESCRIPTION AT THAT PRICE!!!!”

There are 15+ homes that match the description above (and even more homes if we include low-rise buildings) we have used for our example as of September. 29, 2021.

So looking at these numbers, it is easy to oversimplify and say “SEE! IT’S CHEAPER TO RENT”. And YES, at first glance, Andrew is correct; it is cheaper to rent by $821 when calculating the monthly budget. However, in the long run, is it? … Let’s dig a bit deeper.

Each month you pay the mortgage, over 50% goes to the principle amount owing. That means that $1,182 is going back into the home (or your pocket if or when you sell). So what does that mean? If you were to sell your home after your 5 year term for exactly the same price you bought it ($571,000 in this example) you would walk away with $70,920 in your bank account prior to realty fees (which we will get into later) because you essentially paid rent to yourself instead of a landlord.

So overall, month to month we paid $49,620 more over a 5 year period...HOWEVER, we recovered $70,920

Owning:

$2821 x 12months x 5 years = $169,260 total spent

but we've recovered $70,920 when we sold

$169,260-$70,920 = $98,340

Renting:

$2000 x 12months x 5 years + $1000 security deposit = $121,000 total spent

$169,260-$70,920 = $98,340

Renting:

$2000 x 12months x 5 years + $1000 security deposit = $121,000 total spent

we've recovered…..a security deposit

$121,000-$1,000 = $120,000

So we’ve actually saved $21,660 owning a home vs. renting

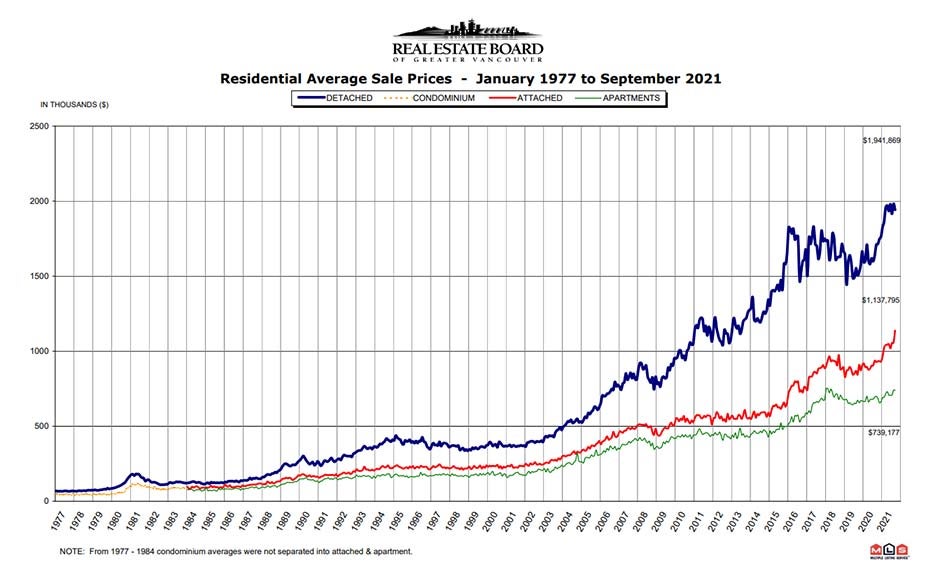

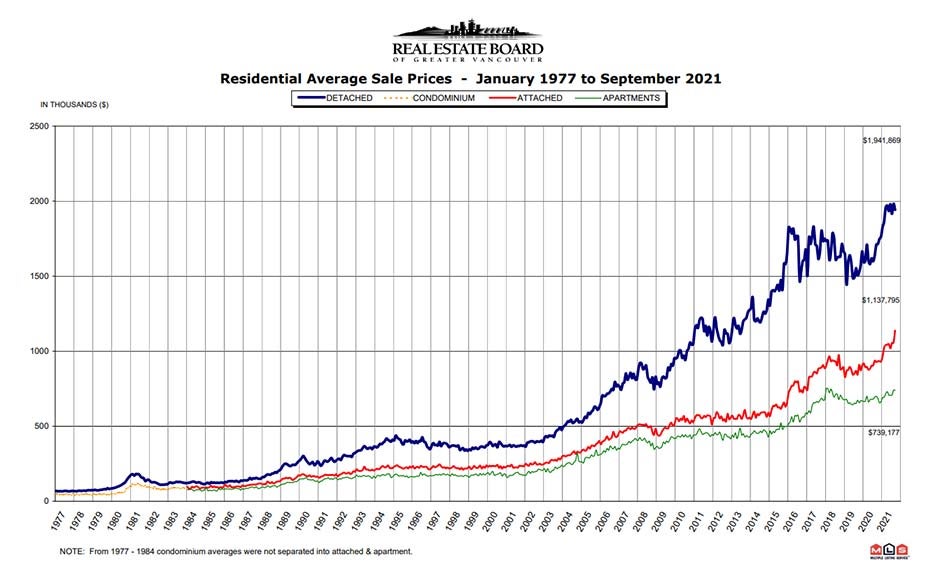

This also doesn’t account for additional factors that we should take into consideration, like annual rent raises which are permitted once per year (and are almost as certain as death and taxes). Another factor is the general rise in home prices, which have held an upward trajectory over almost half a century. They do go up and down, but do have a trend as demonstrated below:

Andrew’s next point:

“If you end up selling and buying, even once over the 25-30 year term of ownership, you will end up even more significantly down due to the selling fees (absurdly expensive). Most people buy and sell a few times in their life.”

$121,000-$1,000 = $120,000

So we’ve actually saved $21,660 owning a home vs. renting

This also doesn’t account for additional factors that we should take into consideration, like annual rent raises which are permitted once per year (and are almost as certain as death and taxes). Another factor is the general rise in home prices, which have held an upward trajectory over almost half a century. They do go up and down, but do have a trend as demonstrated below:

Andrew’s next point:

“If you end up selling and buying, even once over the 25-30 year term of ownership, you will end up even more significantly down due to the selling fees (absurdly expensive). Most people buy and sell a few times in their life.”

There are actually a few issues brought up here. One issue is assuming your home won’t go up in value enough to cover the costs of fees, so let’s look at that graph again. We’ll take his example of selling once in a person’s life, say 25 years since that line up nicely with mortgage terms. If someone were to sell today, that would mean they bought the property in 1996. According to statistics, it’s almost impossible that you won’t make a decent amount of money barring some catastrophic event. If they sell and buy multiple times, which people often do for various reasons like starting a family, career change, etc. Most of the times the fees and transactions are covered by the profit you make from selling the home and the equity you’ve been working hard to build. Just like how you build a fire, start small with kindling and gradually work up to a bonfire.

The other part of this comment seems to be more of a barb at realty advisors, but let’s entertain it anyways. Andrew lives in Vancouver. It is one of the most expensive places for real estate in Canada; which makes commissions higher, which in turn makes the sale price higher. Common practice in the profession here in B.C.

is to charge 6-7% on the first $100,000 and 2.5-3% on the balance of a sale which gets split between the 2 agents (assuming both parties are using an agent).

This fee is NEGOTIABLE and there are even companies that charge as little as 1% if you so desire. As a matter of fact, I even offer a book to people that would like to go at it on their own called “For Sale By Owner” (FSBO) and if you would like more info on that e-mail me at: haze@hazerealty.com

Don’t forget, you get to pick your realty professional. Just like hiring anyone, it’s a good practice to interview a few realty professionals and find the one that fits best with you; remember that sometimes the cheapest isn’t the best and you will get what you pay for… That is a different discussion though.

Andrew’s final point:

“Home ownership might payoff, but it's a gamble that the housing market will continue to increase. All of your eggs are in one basket, and you have little flexibility. Once you buy, you're locked in, and getting out is costly. Don't fall for their marketing mumbo jumbo.”

Andrew is correct to a certain extent. It is a gamble that the market will continue to increase; just like it’s a gamble to invest in anything from stocks to collectibles or art, and nowadays, cryptocurrency. The chances of real estate going to zero is pretty low, especially in Vancouver, and if nothing else owning a home ensures you have a place to keep you out of the rain which is more than can be said for stocks.

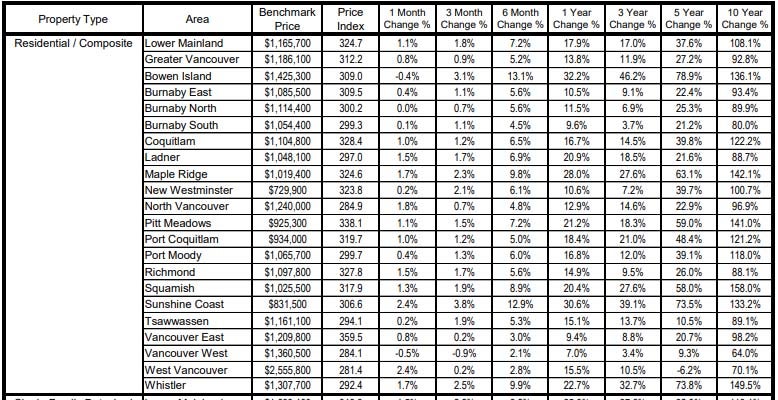

Most people that purchase a home are doing it for a place to live that will help them build equity, which will let them diversify. Below is a graph showing the prices and their increase/decrease over the past months to years as a composite index, there are more stats broken down by type of property etc. and those can be found monthly here: https://www.rebgv.org/market-watch/monthly-market-report.html

We can see overall, most of the properties have increased in value over time (with the exception of West Vancouver’s 5 year %). This all seems like a fairly reasonable gamble and you are going to have to pay to live somewhere most likely anyways; you might as well pay yourself.

As for Andrew’s eggs and putting them into one basket, this isn’t necessarily true. Using one of the first-time buyer programs, a purchaser can borrow from their RRSP (so long as they pay them back), which would mean they are already diversified and don’t have all their eggs in one basket and information on that can be found here:

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/rrsps-related-plans/what-home-buyers-plan/participate-home-buyers-plan.html

And being locked in? I’m not a fan of being locked in, or locked down, for that matter. I am sure if you call any real estate professional you find and ask them to list your home for sale, they will be right over. In fact, there are homes that spend less than a month on the market, sometimes as little as a week. Being that you can sell your home anytime you choose to, that doesn’t seem too locked in.

This concludes our breakdown of the comments section and thank you to “Andrew” for the inspiration to dissect some of the information and misinformation that is floating around in most comment sections.

As they had mentioned with “it’s almost always cheaper to rent”, I disagree. But I do agree that buying doesn’t make sense 100% of the time; sometimes, life hands us circumstances when yes, renting is better.

I can say this with full transparency (as I mentioned above) I work in both the purchase/sale and rental side of the real estate industry; so I’m not pulling for any horse in this race. I hope that it was of help and it’s based on the stats and figures above, not just the “marketing mumbo jumbo”.

If you would like to know more about your area or run some numbers, thoughts, ideas/goals about real estate and whether it makes more sense for you to rent or buy, feel free to contact me and I would be happy to discuss and crunch some numbers with you to help make things make more sense with no obligation to move forward and no charge. There is no one glove that fits all, but things can be tailored!

About the author:

Haze Hartwig is a 3rd generation, 10 year, licensed Realty Advisor and Property Manager with Coldwell Banker Prestige Realty in Vancouver, British Columbia, Canada. That was born and raised in B.C.