The house market for Metro Vancouver showed modest price increases along with more housing entering the market and a steady sales activity.

The total number of residential sales in February reached 3,424, which is an 8.1% decrease in the number of home sold in February 2021 and a 49.8% increase from the number of homes sold in January of this year.

“As we prepare to enter what’s traditionally the busiest season of the year, the Metro Vancouver housing market is seeing more historically typical home sale activity and a modest uptick in home listing activity compared to last year,” Taylor Biggar - REBGV Chair

The total number homes newly list across all three types (Attached, Detached & Apartment) listed for sale was 5,471. This is a 8.4% increase from February of last year and a 31.2% increase from January 2022.

Currently the total number of home listed on the MLS system for Meter Vancouver is 6,742. This represents a 19.3% decrease in comparison to February of last year and a 19.1% increase from January of this year.

“Despite having a higher volume of people listing their homes for sale in February, the region’s housing market remains significantly undersupplied, which has been pushing home prices to new highs month after month,” Biggar said.

The sales-to-active ration for February for all property types combined sits at 50.8%.

The break down for each property type is as follows:

Detached Homes: 34.9%

Townhomes: 64.3%

Apartments: 62.2%

Analysts generally state that downward pressure on home prices occurs when the sales-to-active ratio moves below 12% for a sustained period, while prices of homes will often have upward pressure when it surpasses 20% over a sustained period.

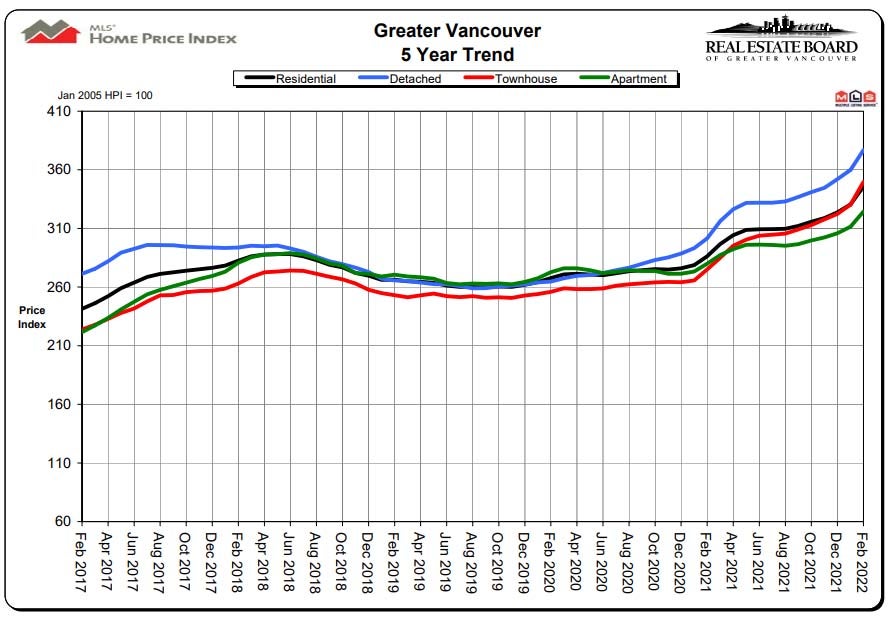

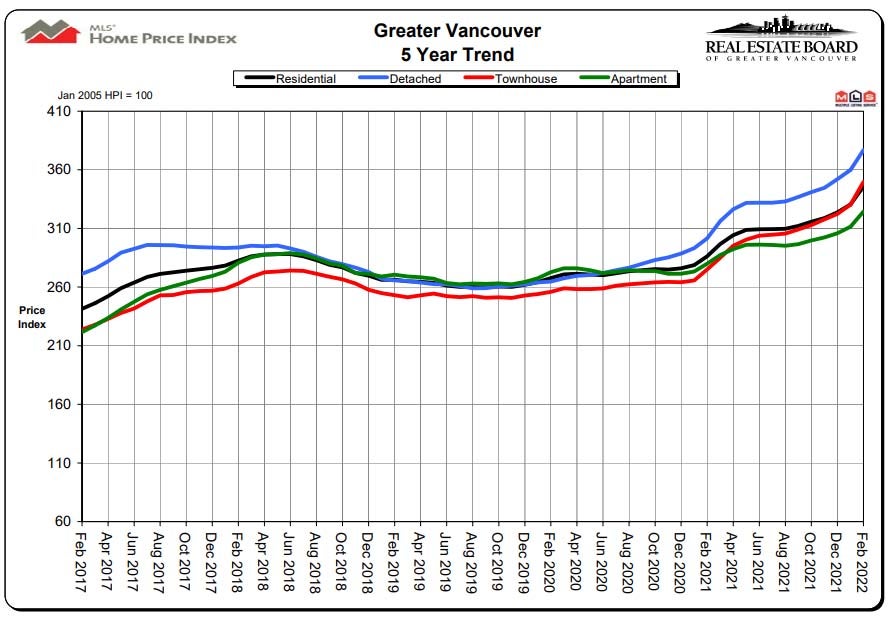

The benchmark price for all residential properties combined in Metro Vancouver is at $1,313,400. This represents a 20.7% increase from February of last year and a 4.6% increase from January of this year.

The total number of sales for detached homes in February 2022 was 1,010; with a benchmark price of 2,044,800. This is a 25% increase from February 2021 and a 4.7% increase from January of this year.

Attached homes reached a total of 560 in February of this year, which is a 24% decrease from February last year and attained a benchmark price of $1,090,000 for 2022. This is a 27.2% increase from February 2021 and a 5.9% increase from January 2022.

Sales of apartments in February 2022 reached a total of 1,854. This is a 5.4% increase from the 1,759 homes that were sold in February 2021. The benchmark price for apartments is $807,900 which represents a 15.9% increase from February last year and a 4.1% increase from January 2022.

Detached Homes: 34.9%

Townhomes: 64.3%

Apartments: 62.2%

Analysts generally state that downward pressure on home prices occurs when the sales-to-active ratio moves below 12% for a sustained period, while prices of homes will often have upward pressure when it surpasses 20% over a sustained period.

The benchmark price for all residential properties combined in Metro Vancouver is at $1,313,400. This represents a 20.7% increase from February of last year and a 4.6% increase from January of this year.

The total number of sales for detached homes in February 2022 was 1,010; with a benchmark price of 2,044,800. This is a 25% increase from February 2021 and a 4.7% increase from January of this year.

Attached homes reached a total of 560 in February of this year, which is a 24% decrease from February last year and attained a benchmark price of $1,090,000 for 2022. This is a 27.2% increase from February 2021 and a 5.9% increase from January 2022.

Sales of apartments in February 2022 reached a total of 1,854. This is a 5.4% increase from the 1,759 homes that were sold in February 2021. The benchmark price for apartments is $807,900 which represents a 15.9% increase from February last year and a 4.1% increase from January 2022.

The Takeaway:

The main driver for the prices continuing to rise remains the same; as the effects of supply and demand keep the competition for a home high. There has been some minor relief with more homes coming into the market, which is traditional for a spring market. With these homes coming online, this has had an effect of spreading out the potential purchasers, which leads to less competition for the homes that are available. If the trend of more homes carries on for an extended period of time this could lead to a more balanced market.

In other news there has been a lot of chatter about a 7-day “cooling off period”, which was presented by Selina Robinson (minister of finance). If this cooling off period is supposed to slow down the market it will likely have the opposite effect as there would be nothing to stop a prospective purchaser from writing 9 offers in a day, seeing which one sticks and then cancelling the rest of the offers. If you multiply this by all the buyers, we will end up with 6 purchasers writing 9 offers and thus send everything into multiple offers. Ms. Robinson also proceeded with saying that “realtors have a vested interest in keeping the housing market hot”…. This is irresponsible and inaccurate.

Most realty professionals prefer a balanced market, where negotiations are part of the transaction as opposed to being an order taker for a property. Additionally if we are to look at who would have a "vested interest in keeping the market hot" (read: prices high), perhaps taking a look at the amount of money that comes into the government via the Property Transfer Tax for EVERY home that is purchased as it is a sliding scale based on the sales price.

A better solution than a period for rescission would be to have a minimum amount of days that a home should be on the market before offers would be permitted to be looked at. This would allow for purchasers to do their due diligence such as reading strata documents at a reasonable pace, inspections and having their financing properly organized prior to writing offers.

A better solution than a period for rescission would be to have a minimum amount of days that a home should be on the market before offers would be permitted to be looked at. This would allow for purchasers to do their due diligence such as reading strata documents at a reasonable pace, inspections and having their financing properly organized prior to writing offers.

Ultimately Metro Vancouver needs a higher supply of homes. The amount of red tape that slows down the process of building, make for longer times from purchasing the plot of land to being able to sell it. This means that a developer will be holding the land doing nothing but costing money. This cost is then passed onto the final purchaser. Simply put, if there are more homes for sale, the prices will be lesser as they are not at a premium.

If you would like a more targeted analysis for your particular area or needs, please feel free to contact me via phone at 604-522-4777 or e-mail directly at

haze-hartwig@coldwellbanker.ca or join us at our Facebook Page (www.facebook.com/HazeRealty)

(Source: http://members.rebgv.org/news/REBGV-Stats-Pkg-February-2022.pdf)

(Source: http://members.rebgv.org/news/REBGV-Stats-Pkg-February-2022.pdf)