A common question for those that are thinking to delve into the world of being a first-time investor is "How will I get that down payment?" This is where EQUITY will come into play for you and why it is a good idea to get your own space to live in before trying to branch out into being an investor.

There is also no one size fits all plan, so if you are contemplating becoming a first-time investor it's a good idea sit down (along with the rest of your team) and make sure to have all the angles covered to make sure that this is the wisest and safest move.

Equity in your home is one of the biggest and strongest tools that are in the box as well as the main reason that we tell people “get into the market first and then use that to move up”.

So what exactly is “equity”??

Equity:

Equity is the difference between the current market appraisal value and what you currently owe.

Here is a very simple example:

Current market value of your home: $400,000

Current amount of mortgage owing: $200,000

You have $200,000 of equity in your home.

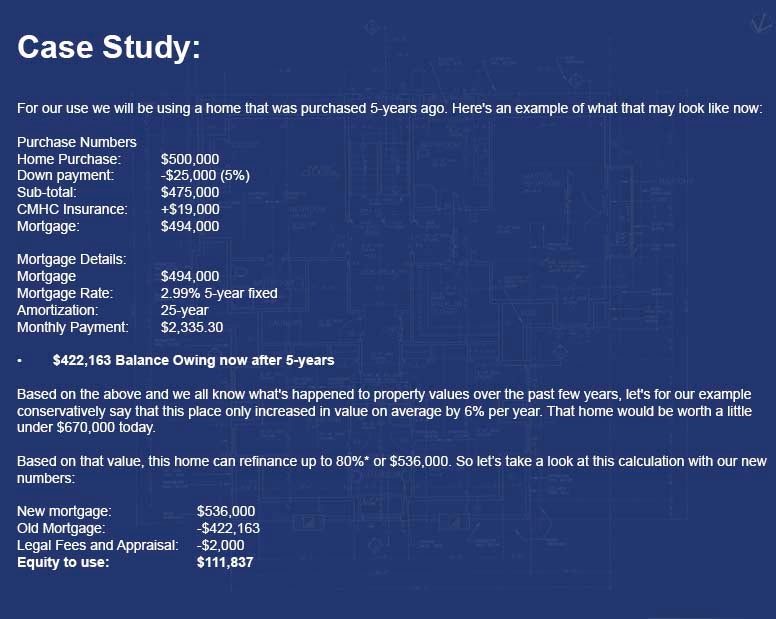

So why are we on about this?? Because this is one of the main methods you can use to collect a down payment for your second income producing home. Now that we have explained a bit about what equity is exactly, let’s take a look at a case study…

This would essentially be enough to cover 20% down payment and closing costs (Property Transfer Tax, Legal, etc.) on a new investment property for $500,000.

And again, these are fairly conservative numbers for property value increase and purchase values 5-years ago. Anyone that purchased for more has likely seen a more significant increase and would therefore have more equity in their home to access.

*Lenders will generally only allow up to 80% of a home’s equity to be accessed for refinancing purposes.

We have now covered a high overview of how a home’s equity can be used to aid in purchasing an investment property. There are of course many other aspects and ways that a home can be leveraged to make it work for you such as looking into Home Equity Line Of Credit (HELOC). This is essentially a line of credit that is attached to your home’s value and can be paid back at will. This method usually has a higher interest rate and both the refinancing method as well as the HELOC method should be discussed in depth with a mortgage specialist (we have a few solid ones if you need one).

We have now covered a high overview of how a home’s equity can be used to aid in purchasing an investment property. There are of course many other aspects and ways that a home can be leveraged to make it work for you such as looking into Home Equity Line Of Credit (HELOC). This is essentially a line of credit that is attached to your home’s value and can be paid back at will. This method usually has a higher interest rate and both the refinancing method as well as the HELOC method should be discussed in depth with a mortgage specialist (we have a few solid ones if you need one).Regardless of which method you choose is correct for you, it is best practice to have the money you leverage for your investment property in a separate account that can be easily verified by the government as the interest on the money that you are using for your investment property is a tax write off; however ONLY the interest on that is and not on your entire mortgage. The interest on the actual rental property is also a tax write off.

Using the numbers from the “Case Study” above ONLY the interest on the maximum $111,837 would be permitted to write off the interest. There are many horror stories of people that have tried to write off all the interest of their home after leveraging some of the equity and results in the tax department coming down HARD on an owner.

As you can tell, for doing proper investment it is good to put together a team that consists of:

1. Mortgage Specialist

2. Accountant

3. Financial Planner

4. Realty Advisor

5. Property Manager

Numbers #4 and #5 are already covered as I carry dual licenses for purchase/sale of real estate as well as rental property management. So if you need some insight for figuring out how to select a rental property with a large rental pool, I can help you with both!

As there are many aspects of this, we will stop here and next look into the mindset of being an investor. It is not like HGTV where amazing return happens after the commercial break!

1. Mortgage Specialist

2. Accountant

3. Financial Planner

4. Realty Advisor

5. Property Manager

Numbers #4 and #5 are already covered as I carry dual licenses for purchase/sale of real estate as well as rental property management. So if you need some insight for figuring out how to select a rental property with a large rental pool, I can help you with both!

As there are many aspects of this, we will stop here and next look into the mindset of being an investor. It is not like HGTV where amazing return happens after the commercial break!

If you have any questions about the items we have covered please feel free to get a hold of me either on my cell phone at 604-522-4777 or via email at haze@hazerealty.com

Being an investor is a great way to build your passive income, empire and portfolio!