Metro Vancouver's housing market saw a decrease in sales in 2022 due to rising borrowing costs caused by the Bank of Canada's efforts to combat inflation. According to the Real Estate Board of Greater Vancouver, there were 28,903 residential home sales in the region in 2022, a 34.3% decrease from 2021 and a 6.6% decrease from 2020. The number of sales in 2022 was 13.4% below the 10-year average.

“The headline story in our market in 2022 was all about inflation and the Bank of Canada’s efforts to bring inflation back to target by rapidly raising the policy rate. This is a story we expect to continue to make headlines into 2023, as inflationary pressures remain persistent across Canada,”. - Andrew Lis (REBGV’s director, economics and data analytics)

There were 53,865 home listings on the MLS in Metro Vancouver in 2022, a 13.5% decrease from 2021 and a 0.8% decrease from 2020. The number of listings in 2022 was 3.2% below the 10-year average for the region. As of now, there are 7,384 homes currently listed for sale on the MLS in Metro Vancouver, a 41% increase from December 2021 and a 19.6% decrease from November 2022.

As of December 2022, there are 7,384 homes listed for sale on the MLS in Metro Vancouver, representing a 41% increase from the previous month and a 19.6% decrease from November 2022. The MLS Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,114,300, indicating a 3.3% decrease from December 2021, a 1.5% decrease from the previous month, and a 9.8% decrease over the past six months.

“Closing out 2022, the data showed that the Bank of Canada’s decisions to increase the policy rate at seven of the eight interest rate announcement dates in 2022 has translated into downward pressure on home sale activity and, to a lesser extent, home prices in Metro Vancouver,” Lis said. “While the consensus among many economists and forecasters suggests the Bank of Canada may be near the end of this tightening cycle, rates may remain elevated for longer than previously expected since the latest inflation figures aren’t showing signs of abating quickly. We’ll watch the 2023 spring market closely to see if buyers and sellers have adjusted to the higher borrowing-costs and are participating more actively in the market than we have seen over the last 12 months.”

In December 2022, there were 1,295 residential home sales in the region, a 51.8% decrease from the previous December and a 19.8% decrease from November 2022. This number was 37.7% below the 10-year December sales average.

There were 1,206 detached, attached, and apartment properties newly listed for sale on the MLS in Metro Vancouver in December 2022, a 38% decrease from the previous December and a 60.5% decrease from November 2022.

The sales-to-active listings ratio for December 2022 sits at 17.5% for all property types combined (detached, townhomes & apartments) and they break down by property type as follows:

Detached: 12.3%

Townhome: 19.5%

Apartment: 21.7%

Analysts generally state that downward pressure on home prices occurs when the sales-to-active ratio moves below 12% for a sustained period, while prices of homes will often have upward pressure when it surpasses 20% over a sustained period.

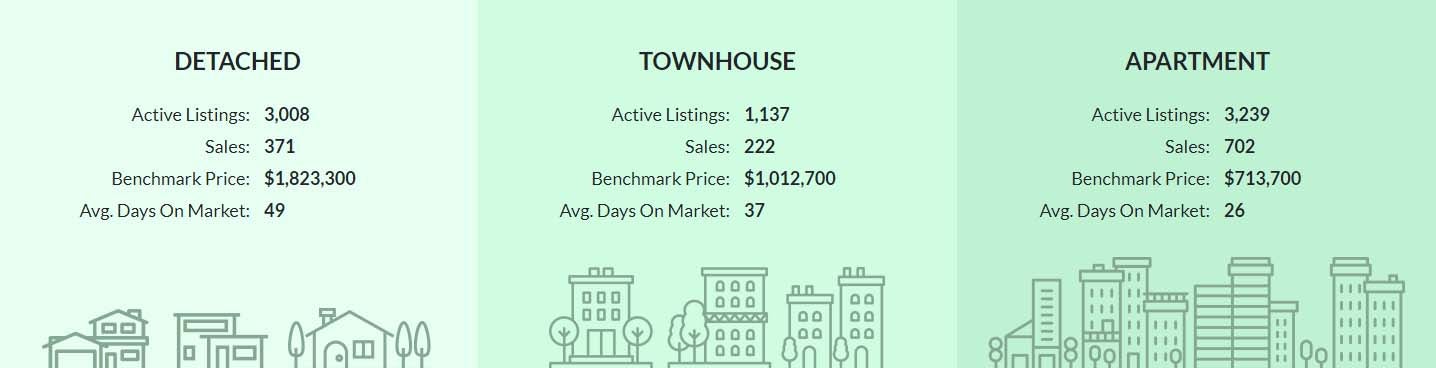

In December 2022, there were 371 sales of detached homes, a 53.3% decrease from December 2021. The benchmark price for a detached home in December 2022 was $1,823,300, representing a 5.1% decrease from the previous December, a 1.8% decrease from November 2022, and an 11.4% decrease over the past six months.

Sales of apartments reached a total of 702 for December of this year, a 52% decrease from December 2021. The benchmark price for an apartment home in December 2022 was $713,700, representing a 1.7% increase from the December 2021, a 0.9% decrease from November 2022, and a 6.9% decrease over the past six months.

Attached home sales in December 2022 decreased by 48.4% compared to the previous year, totaling 222 sales. The benchmark price for an attached home in December 2022 was $1,012,700, which was a 0.2% decrease from the previous December and a 1.5% decrease from November 2022. This benchmark price has decreased by 9.2% over the past six months.

THE TAKE AWAY:

As the mortgage rates have kept climbing, it has the effect of lowering purchaser power. This in turn will cause there to be downward pressure on pricing since with the higher rates, a lot of the population simply cannot attain the price. This will cause any (serious) new listings to have to enter the market at a lower price if they intend to actually sell. Should these newer listings sell, they will then become comparable units for the other units that are still available and thus will further have a cooling effect on prices.

THE TAKE AWAY:

As the mortgage rates have kept climbing, it has the effect of lowering purchaser power. This in turn will cause there to be downward pressure on pricing since with the higher rates, a lot of the population simply cannot attain the price. This will cause any (serious) new listings to have to enter the market at a lower price if they intend to actually sell. Should these newer listings sell, they will then become comparable units for the other units that are still available and thus will further have a cooling effect on prices.

HOWEVER…

Many of the units that were listing during the insanely hot past year(s) do not HAVE to sell and may simply pull them off the market and continue to either rent or be used for their personal use. This is also the main reason why I am of the opinion that there is not a “bubble” as part of the bubble theory is that the people selling NEED to over WANT to.

This brings us to a position of basically who is going to blink first. Will sellers react by lowering prices or will buyers have to wait until the rates start to come down? Needless to say we will likely see a very slow first quarter. Time will tell how this all pans out.

If you would like a more targeted analysis for your particular area or needs, please feel free to contact me via phone at 604-522-4777 or e-mail directly at: haze@hazerealty.com or join us at our Facebook Page (www.facebook.com/HazeRealty)

(Source: https://members.rebgv.org/news/REBGV-Stats-Pkg-Dec-2022.pdf)