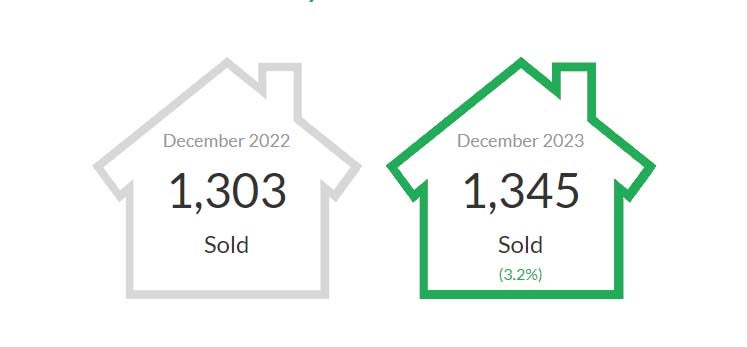

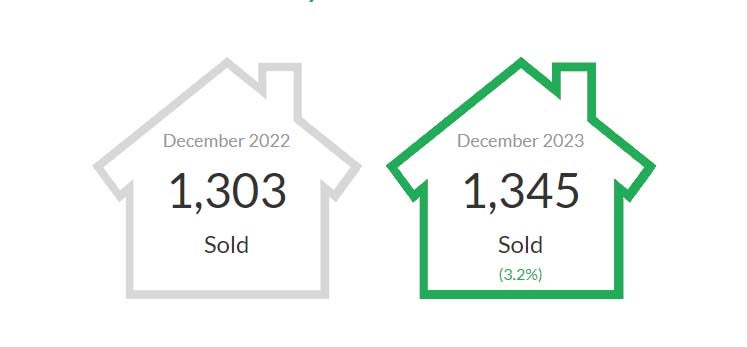

In December 2023, residential sales in the region reached a total of 1,345, marking a 3.2% rise from the 1,303 sales documented in December 2022. However, this figure fell significantly, registering a 36.4% decrease below the 10-year seasonal average of 2,114.

Additionally, there were 1,327 newly listed detached, attached, and apartment properties for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in December 2023. This reflected a 9.9% increase compared to the 1,208 properties listed in December 2022. Nevertheless, it remained 22.7% below the 10-year seasonal average of 1,716.

The sales-to-active listings ratio for December 2023 landed at 16% for all property types combined and broke down per types as follows:

Detached: 11.1%

Attached: 18.7%

Apartment: 19.6%

Historical data suggests that sustained ratios below 12% exert downward pressure on home prices, while those exceeding 20% over several months typically lead to upward price trends.

In December 2023, the sales of detached homes amounted to 376, indicating a 1.3% uptick from the 371 detached sales recorded in December 2022. The benchmark price for a detached home stands at $1,964,400, reflecting a 7.7% increase from December 2022 and a slight 0.9% decrease compared to November 2023.

As for attached homes, sales in December 2023 totaled 238, indicating a 7.2% increase from the 222 sales in December 2022. The benchmark price for a townhouse is $1,072,700, demonstrating a 6.4% increase from December 2022 and a 1.8% decrease compared to November 2023.

Apartment home sales reached 719 in December 2023, marking a 2.4% increase compared to the 702 sales in December 2022. The benchmark price for an apartment home is $751,300, showcasing a 5.6% rise from December 2022 and a 1.5% dip compared to November 2023.

THE TAKE AWAY:

Over the course of last year (2023) the real estate market was subjected to what seemed to be ever increasing interest rates. This had an effect on Greater Vancouver as it pushed would-be buyers to the sidelines in a holding pattern as many were concerned that the rates would continue to rise and others were simply forced to the sidelines as their buying power was drastically reduced. In turn this caused many sellers to not get involved in marketing their homes as they were aware that they may not get the top dollar desired for their home. This caused a shortage of homes for sale and thus caused upward pressure on prices due to principles of supply and demand. There is still an overall desire to purchase for many and with most economists predicting rates to start to dropping towards the middle of this year, when that happens we will likely see a flurry of activity as it may signal to both buyers and sellers alike that the increases are over and give them more of a sense of security in the market.

What will be something to watch however is that on May 1st of this year is when the new rules for AirBNB takes hold. On the rental side of the business we have noticed an uptick of owners trying to rent out their homes long term, furnished. We believe these to be AirBNB units that are attempting to switch from short-term to long term. Should the numbers not line up for a landlord we suspect that we may see an uptick in homes coming on the sales market that were once solely used for short-term rental investment. This may coincide with the projected drop in the interest rates, which may further entice owners to sell their units in the buying frenzy and cash out over holding the unit as a long term rental.

If you would like to have to some real world advice about how to navigate the current market and plan for the future call or text me at 604-522-4777 or e-mail directly at: haze@hazerealty.com or join us at our Facebook Page (www.facebook.com/HazeRealty) and we see what the best move can be.

(Source: https://www.rebgv.org/market-watch/monthly-market-report/december-2023.html)

Additionally, there were 1,327 newly listed detached, attached, and apartment properties for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in December 2023. This reflected a 9.9% increase compared to the 1,208 properties listed in December 2022. Nevertheless, it remained 22.7% below the 10-year seasonal average of 1,716.

The sales-to-active listings ratio for December 2023 landed at 16% for all property types combined and broke down per types as follows:

Detached: 11.1%

Attached: 18.7%

Apartment: 19.6%

Historical data suggests that sustained ratios below 12% exert downward pressure on home prices, while those exceeding 20% over several months typically lead to upward price trends.

In December 2023, the sales of detached homes amounted to 376, indicating a 1.3% uptick from the 371 detached sales recorded in December 2022. The benchmark price for a detached home stands at $1,964,400, reflecting a 7.7% increase from December 2022 and a slight 0.9% decrease compared to November 2023.

As for attached homes, sales in December 2023 totaled 238, indicating a 7.2% increase from the 222 sales in December 2022. The benchmark price for a townhouse is $1,072,700, demonstrating a 6.4% increase from December 2022 and a 1.8% decrease compared to November 2023.

Apartment home sales reached 719 in December 2023, marking a 2.4% increase compared to the 702 sales in December 2022. The benchmark price for an apartment home is $751,300, showcasing a 5.6% rise from December 2022 and a 1.5% dip compared to November 2023.

THE TAKE AWAY:

Over the course of last year (2023) the real estate market was subjected to what seemed to be ever increasing interest rates. This had an effect on Greater Vancouver as it pushed would-be buyers to the sidelines in a holding pattern as many were concerned that the rates would continue to rise and others were simply forced to the sidelines as their buying power was drastically reduced. In turn this caused many sellers to not get involved in marketing their homes as they were aware that they may not get the top dollar desired for their home. This caused a shortage of homes for sale and thus caused upward pressure on prices due to principles of supply and demand. There is still an overall desire to purchase for many and with most economists predicting rates to start to dropping towards the middle of this year, when that happens we will likely see a flurry of activity as it may signal to both buyers and sellers alike that the increases are over and give them more of a sense of security in the market.

What will be something to watch however is that on May 1st of this year is when the new rules for AirBNB takes hold. On the rental side of the business we have noticed an uptick of owners trying to rent out their homes long term, furnished. We believe these to be AirBNB units that are attempting to switch from short-term to long term. Should the numbers not line up for a landlord we suspect that we may see an uptick in homes coming on the sales market that were once solely used for short-term rental investment. This may coincide with the projected drop in the interest rates, which may further entice owners to sell their units in the buying frenzy and cash out over holding the unit as a long term rental.

If you would like to have to some real world advice about how to navigate the current market and plan for the future call or text me at 604-522-4777 or e-mail directly at: haze@hazerealty.com or join us at our Facebook Page (www.facebook.com/HazeRealty) and we see what the best move can be.

(Source: https://www.rebgv.org/market-watch/monthly-market-report/december-2023.html)