February saw new listings rise 31% from the year-over-year number recorded in February; bringing much needed inventory to the Greater Vancouver market.

February saw new listings rise 31% from the year-over-year number recorded in February; bringing much needed inventory to the Greater Vancouver market.Sales in Greater Vancouver reached a total of 2,070 in February 2024, which is a 13.5% increase from the previous year and 23.3% lower than the 10-year seasonal average.

“While the pace of home sales started the year off briskly, the pace of newly listed properties in January was slower by comparison. A continuation of this pattern in February would have been concerning, as it could quickly tilt the market towards overheated conditions,” Andrew Lis, GVR’s director of economics and data analytics said. “With new listings up about 31 per cent year-over-year in February, this will relieve some of the pressure that was building in January and offer buyers more choice as we enter the spring and summer markets.”

The total number of homes currently listed on the Multiple Listing Service currently sits at 9,634. This is a 16.3% increase from February of last year and is 3% above the 10-year seasonal average.

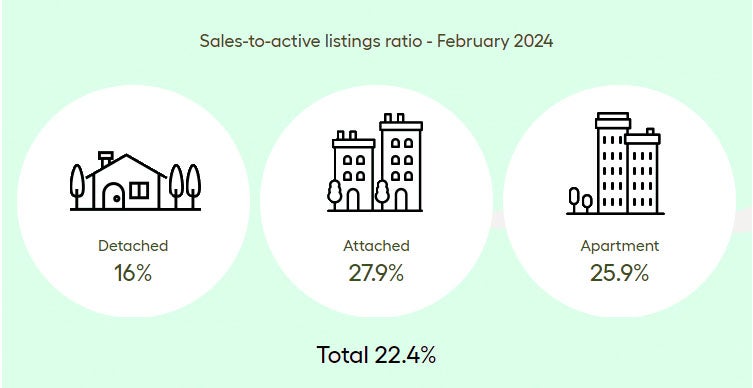

The sales-to-active listings ratio sits at 22.4% for all property types combined and breaks down by property type as follows:

Detached: 16%

Attached: 27.9%

Apartment: 25.9%

Historical data suggests that sustained ratios below 12% exert downward pressure on home prices, while those exceeding 20% over several months typically lead to upward price trends.

“Even with the increase in new listings however, standing inventory levels were not high enough relative to the pace of sales to mitigate price acceleration in February, with most segments of the market moving into sellers’ territory,” Lis said. “This competitive dynamic has led to modest price growth across all market segments this month, but it’s noteworthy that benchmark prices remain below the peak observed in the spring of 2022, before the market internalized the full effect of the Bank of Canada’s tightening cycle.”

In February 2024, the sales of detached homes amounted to 560, marking an 8.3 percent rise from the 517 sales recorded in February 2023. The benchmark price for detached homes stands at $1,972,400, reflecting a 7.2 percent increase from February 2023 and a 1.5 percent uptick compared to January 2024.

For apartment homes, sales in February 2024 reached 1,092, indicating a 17.7 percent increase from the 928 sales in February 2023. The benchmark price for apartment homes is $770,700, showing a 5.6 percent increase from February 2023 and a 2.5 percent rise compared to January 2024.

In February 2024, attached home sales totaled 403, marking a 10.1 percent increase compared to the 366 sales in February 2023. The benchmark price for a townhouse is $1,094,700, showcasing a 4.2 percent increase from February 2023 and a 2.6 percent increase compared to January 2024.

THE TAKEAWAY:

While we have had an increase in the number of homes that have come to the market for purchase we still do not have an abundance of homes for sale. Traditionally the sales activity picks up in the spring and with the Bank of Canada (BoC) again holding the rates, this will signal to more buyers that the increases are over. This will build more confidence and bring more buyers off the sidelines as they will have less fear that the rates will keep climbing… It is this realty advisor’s opinion that should rates decrease, we will see a large uptick in sales activity and thus more competition for homes… Expect prices to rise when the interest drops.

It would be amiss to not discuss the 2 new changes that our government has brought in to help with pricing and getting more people into the market; so let’s get into it.

The BC Home Flipping Tax:

This is a tax that was brought in to help with those that are speculating and buying and selling home within a two-year period. This will apply to both properties and assignments of contract on top of the additional federal and provincial income taxes. According to the BC Real Estate Association short-term flipping represents less and 2% of sales activity in both Vancouver and Victoria. This tax is basically make-belief so that our government looks like they are actually doing something. This will also have some interesting market reactions such as some homes being used as rentals for 2 years and then being sold after the time limit for the tax has passed. (Hint: IF you are a tenant that has just moved into a brand new rental, be weary as you may have to move in 2 years)

The real way for pricing to come down is for our government to take responsibility and allow for more homes to be built at a breakneck pace as we are clearly behind for the number of spaces to the number of people.

First-Time Buyer Property Tax Exemptions:

Previously the first-time buyer exemption for Property Transfer Tax (PTT) ceased at $500,000 with partial exemptions up to $525,000. This has now been updated that there is no tax up to $500,000 and there is a sliding scale up to $835,000 and partial exemptions up to $860,000. This can save purchasers up to $8000 and is better than the cut off at $500,000. This is a step in the right direction; however why not just make first-time buyers fully exempt up to the $835,000? The government will be making taxes off of every sale after the first one, so giving a break to the very first one would not be too much to ask.

If you would like to have to some real world advice about how to navigate the current market and plan for the future call or text me at 604-522-4777 or e-mail directly at: haze@hazerealty.com or join us at our Facebook Page (www.facebook.com/HazeRealty) and we see what the best move can be.

(Source: https://www.gvrealtors.ca/market-watch/monthly-market-report/february-2024.html)