Great news for homebuyers in Metro Vancouver! The amount of homes available for sale has increased by almost 23% compared to last year, giving buyers more options this spring.

According to the latest report from the Greater Vancouver REALTORS®, there were 2,415 residential sales in March 2024. While this represents a slight drop of 4.7% from March 2023, it's worth noting that it's significantly lower than the average over the past decade, by about 31.2%.

“If you’re finding the weather a little chillier than last spring, you may find some comfort in knowing that the market isn’t quite as hot as it was last spring either, particularly if you’re a buyer,” Andrew Lis, GVR’s director of economics and data analytics said. “Despite the welcome increase in inventory, the overall market balance continues inching deeper into sellers’ market territory, which suggests demand remains strong for well-priced and well located properties.”

In March 2024, Metro Vancouver saw a notable increase in newly listed properties available for sale, with a total of 5,002 detached, attached, and apartment properties hitting the market. This marks a 15.9% rise compared to March 2023. However, it's slightly below the average for this time of year over the past decade.

Currently, there are 10,552 properties listed for sale on the MLS® system in Metro Vancouver, showing a substantial 22.5% increase compared to March 2023. This surpasses the average for this season over the past decade.

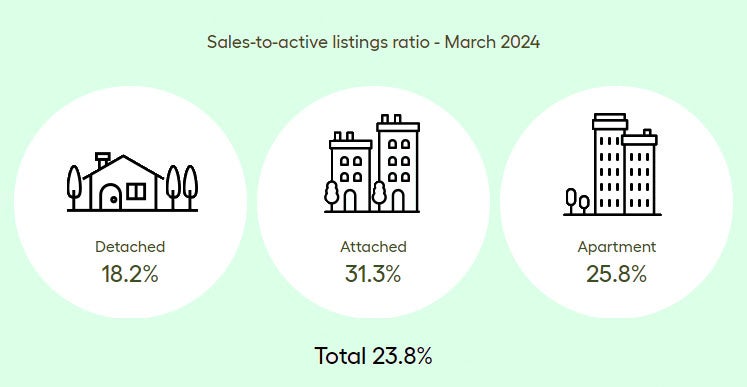

Analyzing the sales-to-active listings ratio for March 2024, we find it stands at 23.8% across all property types. This breaks down by type as follows:

Detached homes: 18.2%

Attached: 31.3%

Apartments: 25.8%

These figures give valuable insights into the current dynamics of the real estate market in Metro Vancouver.

Historical data suggests that sustained ratios below 12% exert downward pressure on home prices, while those exceeding 20% over several months typically lead to upward price trends.

“Even though the market isn’t quite as hot as it was last year, we’re still seeing modest month over month price gains of one to two per cent happening at the aggregate level, which is an interesting dynamic given that borrowing costs remain elevated,” Lis said. “With the latest inflation numbers trending in the right direction, it remains likely that we’ll see at least one or two modest cuts to the Bank of Canada’s policy rate in 2024, but even if these cuts come, they may not provide the boost to affordability many had been hoping for. As a result, we expect constrained borrowing power to remain a challenging headwind as we move into the summer months.”

In Metro Vancouver, the current MLS® Home Price Index shows that the average benchmark price for all residential properties stands at $1,196,800. This reflects a 4.5% increase from March 2023 and a 1.1% increase from February 2024.

Breaking it down further, sales of detached homes in March 2024 reached 694, a slight decrease of 5.4% compared to March 2023. However, the benchmark price for a detached home is now $2,007,900, marking a notable 7.4% increase from March 2023 and a 1.8% increase from February 2024.

For apartment homes, sales totaled 1,207 in March 2024, showing a decrease of 7.9% from March 2023. Yet, the benchmark price for an apartment home is $777,500, indicating a 5.7% increase from March 2023 and a 0.9% increase from February 2024.

As for attached homes, sales in March 2024 totaled 495, representing a 6.2% increase from March 2023. The benchmark price for a townhouse is $1,112,800, marking a 5% increase from March 2023 and a 1.7% increase from February 2024.

These figures give a snapshot of the current market trends in Metro Vancouver, providing valuable insights for both buyers and sellers.

THE TAKEAWAY:

THE TAKEAWAY:With the announcement by the Bank of Canada (BoC) of yet again holding the rates as they are this will aid would-be buyers in accepting that this is the way of the market now. Traditionally there is an uptick in activity in the spring months each year, so we will likely see the homes that are available get snapped up quickly. It is believed by many economists that we will see a rate decrease in the middle of the year.

The federal budget is to be released on April 16th, 2024 in which we will likely have a better outlook on the market as well as see what any changes may occur. As with any changes in the market, when they occur, the market slows for a short period and carries on.

It is my personal belief that we will see some rate decreases this year as well and into 2025 as there is a federal election pending and simply put “broke people don’t vote for you”. Dropping the rates, will likely cause a flurry of activity, which in turn will push prices up and competition will be fierce. We have already seen some motions to aid first-time buyers through extending the relief of the Property Transfer Tax in BC as well as federally allowing for 30-year mortgages for first-time buyers of new homes. These may all be simply moves to garner more votes from a younger voting demographic (question: why not allow for 30-year mortgages on all homes?)

In a nutshell, when rates drop there will likely be a heap of competition and will raise the prices, stress and be very hard on all buyers, including the first-time ones. The best move right now is that if you are thinking of getting into the market, move before the rate drop or you will likely end up paying more for your home in the long run.

If you would like to have to some real world advice about how to navigate the current market and plan for the future call or text me at 604-522-4777 or e-mail directly at: haze@hazerealty.com or join us at our Facebook Page (www.facebook.com/HazeRealty) and we see what the best move can be.

(Source: https://www.gvrealtors.ca/market-watch/monthly-market-report/march-2024.html)