“The trend of buyers remaining hesitant, that began a few months ago, continued in the July data despite a fresh quarter percentage point cut to the Bank of Canada’s policy rate,” Andrew Lis, GVR’s director of economics and data analytics said. “With the recent half percentage point decline in the policy rate over the past few months, and with so much inventory to choose from, it’s a bit surprising transaction levels remain below historical norms as we enter the mid-point of summer.”

In July 2024, 5,597 homes, including detached houses, townhomes, and apartments, were newly listed for sale in Metro Vancouver. This is a 20.4% increase from the 4,649 homes listed in July 2023 and 12.7% higher than the typical 10-year average for this time of year.

Currently, there are 14,326 homes available for sale on the MLS® in Metro Vancouver, which is a 39.1% increase from July 2023 and 21.5% above the 10-year average.

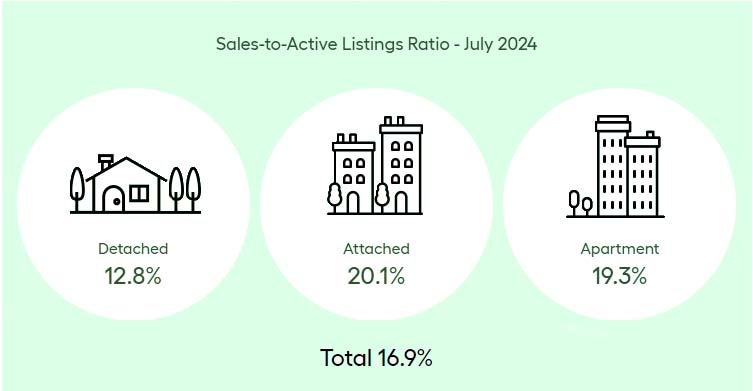

The sales-to-active listings ratio for July 2024 is 16.9% across all property types. Specifically, it’s 12.8% for detached homes, 20.1% for townhomes, and 19.3% for apartments.

Historical data suggests that sustained ratios below 12% exert downward pressure on home prices, while those exceeding 20% over several months typically lead to upward price trends.

“With the overall market experiencing balanced conditions, and with a healthy level of inventory not seen in quite a few years, price trends across all segments have leveled out with very modest declines occurring month over month,” Lis said. “While it remains to be seen whether softening prices and improved borrowing costs will entice buyers to purchase as we head into the fall market, it’s worth noting that it can take a few months for improvements to borrowing costs to materialize into higher transaction levels. In this respect, it’s still early days, so we will watch the market for signs of transaction activity picking up in the months ahead.”

The average price for all types of homes in Metro Vancouver is currently $1,197,700, which is down 0.8% from both July 2023 and June 2024."

Detached homes had 688 sales in July 2024, a slight 1% increase from July 2023. The average price for a detached home is $2,049,000, up 2.1% from last year but down 0.6% from June 2024

.

For apartments, 1,192 were sold in July 2024, a 6.9% drop compared to July 2023. The average apartment price is $768,200, which is 0.3% lower than last year and 0.7% lower than last month.

For apartments, 1,192 were sold in July 2024, a 6.9% drop compared to July 2023. The average apartment price is $768,200, which is 0.3% lower than last year and 0.7% lower than last month.

Townhomes had 437 sales in July 2024, a 6.2% decrease from July 2023. The average price for a townhome is $1,124,700, up 1.4% from last year but down 1.2% from June 2024.

The Take Away:

There has been a lot of inventory that has come on the market, however buyers are still weary from the repeated increases in the interest rates. The increases greatly reduced the buying power of purchasers and thus sent them to the sidelines. Typically the market slows down in August as people are getting their last summer adventures in and families are preparing to go back to school. The bank of Canada is set to meet again on Sept 4th and many economists are calling for a 0.5% drop in the interest rates, which will bring more purchasing power to the buyers. One thing to note is that sellers have been sticking by their guns on the pricing, which would be a logical reason that the prices have not dropped too heavily with all the homes on the market. This is yet again more proof that the fabled “bubble” doesn’t exist since a key factor to a bubble is that people are forced to sell. Many homes in the Greater Vancouver area have little or no mortgage on them.

A savvy purchaser may want to look and put in some offers prior to Sept 4 as they will have some negotiating power and more selection. Then they can lock up a home at a more favourable price and enjoy a likely lower interest rate than they are currently looking at.

I do believe that we will see an uptick in activity come September simply due to traditionally the transactions pick up in the Fall and coupled with a 3rd consecutive interest rate drop, it will bring more consumer confidence in the market as a whole.

If you would like to have to some real world advice about how to navigate the current market and plan for the future call or text me at 604-522-4777 or e-mail directly at: haze@hazerealty.com or join us at our Facebook Page (www.facebook.com/HazeRealty) and we see what the best move can be.

Source: https://members.gvrealtors.ca/news/GVR-Stats-Package-July-2024.pdf