In August, home sales in Metro Vancouver were lower than the usual 10-year average, partly because many people are wrapping up their summer holidays.

Realtors in the area reported that 1,904 homes were sold in August 2024, which is about 17% less than the 2,296 homes sold in August 2023. It’s also 26% below the typical sales average for this time of year, which is usually 2,572 homes.

Andrew Lis, a local real estate expert, explained that August is generally a slower month for home sales compared to June and July. He also mentioned that sales are still lower than the 10-year average because buyers are being cautious due to higher borrowing costs, even though interest rates were reduced slightly over the summer.

In August 2024, 4,109 new homes (including detached houses, townhomes, and apartments) were listed for sale. This is a small increase of 4.2% compared to last year, but still a bit below the 10-year average for new listings. The total number of homes available for sale in the region is now 13,812, which is a big jump—37% higher than in August 2023 and over 20% above the 10-year average.

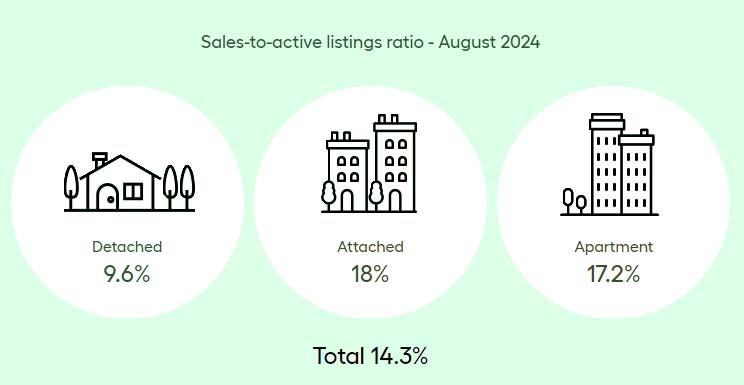

The ratio of sales to active listings, which helps gauge how strong the market is, was 14.3% in August 2024. By property type, this ratio was 9.6% for detached homes, 18% for townhomes, and 17.2% for apartments. Experts say that when this ratio drops below 12%, home prices tend to go down. When the ratio goes above 20%, prices usually go up.

Lis added that many buyers are still holding off, while sellers are putting homes on the market at a normal pace. This has led to more inventory and a more balanced market. With the Bank of Canada lowering interest rates again, and September typically being a busier month, there’s a chance more buyers will enter the market in the fall.

As of August 2024, the average price for all types of homes in Metro Vancouver is $1,195,900. This is slightly lower (0.9%) than August 2023 and a tiny drop (0.2%) from July 2024.

Looking at specific types of homes:

- Detached homes: 509 were sold in August 2024, a decrease of 13.9% compared to last year. The average price is $2,048,400, up 1.8% from last year, but unchanged from July.

- Apartments: 1,012 were sold, down 20.3% from last year. The average price is $768,200, basically the same as both last year and July 2024.

- Townhomes: 370 were sold, a drop of 12.3% compared to last year. The average price is $1,119,300, up 0.8% from last year but down slightly from July (0.5%).

The Take Away:

We have seen a heap of homes come on the market. Typically this causes downward pressure on prices over a longer period of time. Many buyers were put to the sidelines from sudden and heavy increases to the interest rate. More buyers have been starting to come back to the market and a clever one would be to try to make a purchase later in the year around later October or November if possible. The logic being that most are anticipating another drop in the interest rate come December, when they Bank of Canada meets again.

We have seen a heap of homes come on the market. Typically this causes downward pressure on prices over a longer period of time. Many buyers were put to the sidelines from sudden and heavy increases to the interest rate. More buyers have been starting to come back to the market and a clever one would be to try to make a purchase later in the year around later October or November if possible. The logic being that most are anticipating another drop in the interest rate come December, when they Bank of Canada meets again.

This maneuver would result in there being a lot of homes to look at, less competition and a buyer would be able to enjoy a lower interest rate when they do actually complete the purchase than when they originally made the offer... As the say goes: "date the rate, marry the house."

Sellers will have to be sharp on their price and patient as we have had a serious increase in the sheer amount of homes on the market and thus need to stand out. Some are having to deal with the acceptance that the prices are not as high as they used to be; however that may change come the spring of 2025.

If you would like to have to some real world advice about how to navigate the current market and plan for the future call or text me at 604-522-4777 or e-mail directly at: haze@hazerealty.com or join us at our Facebook Page (www.facebook.com/HazeRealty) and we see what the best move can be.