Home sales in Metro Vancouver, as tracked by the Multiple Listing Service (MLS), jumped by over 30% in December compared to the same time last year, showing stronger demand as 2024 ended. According to the Greater Vancouver Realtors (GVR), the region saw 26,561 residential sales in 2024, which is 1.2% higher than the 26,249 sales in 2023 but 9.2% lower than the 29,261 sales recorded in 2022. Despite the growth, last year’s total sales were still 20.9% below the 10-year annual average of 33,559.

“Looking back on 2024, it could best be described as a pivot year for the market after experiencing such dramatic increases in mortgage rates in the preceding years,” said Andrew Lis, GVR’s director of economics and data analytics. “With borrowing costs now firmly on the decline, buyers have started to show up in numbers after somewhat of a hiatus – and this renewed strength is now clearly visible in the more recent monthly data.”

In 2024, 60,388 properties were listed on the MLS system in Metro Vancouver, an 18.7% increase compared to 50,894 listings in 2023 and 9.7% higher than the 55,047 listings in 2022. This total was also 5.7% above the region’s 10-year annual average of 57,136.As of now, there are 10,948 homes listed for sale, which is 24.4% more than the 8,802 listings in December 2024 and 25.3% above the 10-year seasonal average of 8,737.

The current benchmark price for residential properties in Metro Vancouver is $1,171,500, up 0.5% from December 2023 but down 0.1% from November 2024.

“Disappointingly, sales came in shy of our forecasted target for the year, but the December figures signal an emerging pattern of strength in home sales, building on the momentum seen in previous months,” Lis said. “These more recent sales figures are now trending back towards long-term historical averages, which suggests there may still be quite a bit of potential upside for sales as we head into 2025, should the recent strength continue. “Although sales activity had a slower start to the year, price trends began 2024 on the rise and closed out the year on a flatter trajectory. Most market segments saw year-over-year increases of a few per cent except for apartment units, which ended 2024 roughly flat. With the data showing renewed strength to finish the year however, it looks as though the 2025 market is positioned to be considerably more active than we’ve seen in recent years.”

In December 2024, residential sales in Metro Vancouver totaled 1,765, a 31.2% increase from the 1,345 sales in December 2023 but 14.9% below the 10-year seasonal average of 2,074.

New listings for detached, attached, and apartment properties reached 1,676, up 26.3% from 1,327 in December 2023, and just 1.1% below the 10-year seasonal average of 1,695.

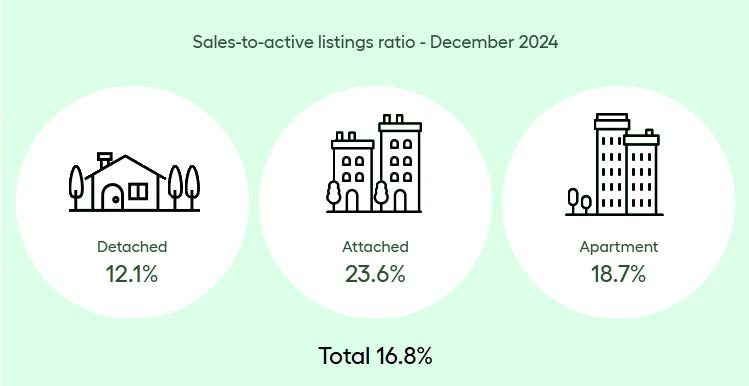

The overall sales-to-active listings ratio was 16.8%, with detached homes at 12.1%, attached homes at 23.6%, and apartments at 18.7%. Historically, home prices tend to decline when the ratio stays below 12% and rise when it exceeds 20% for an extended period.

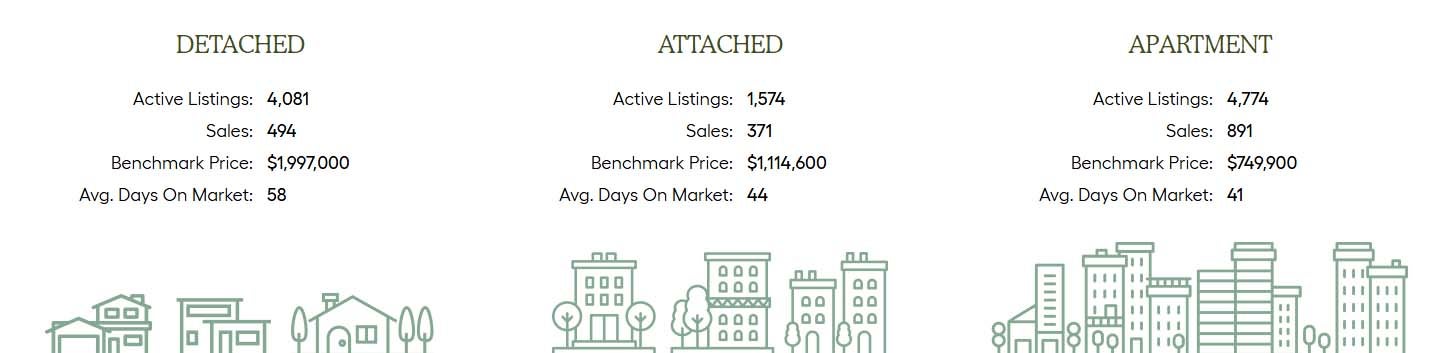

- Detached homes: Sales rose 31.4% to 494 compared to 376 in December 2023. The benchmark price was $1,997,000, up 2% from December 2023 and steady compared to November 2024.

- Apartments: Sales increased by 23.9% to 891, up from 719 in December 2023. The benchmark price was $749,900, a 0.1% decrease from December 2023 and a 0.4% drop from November 2024.

- Attached homes (townhouses): Sales surged 55.9% to 371 compared to 238 in December 2023. The benchmark price was $1,114,600, up 3.4% from December 2023 and down 0.3% from November 2024.

THE TAKE AWAY:

With there being 2 rate drops at the end of the year, the buyers have maintained a holding pattern still but with a different outlook. Instead of waiting to see when the rates will start coming down out of fear for them rising more, many buyers are now waiting to see how low they can go. While this doesn't affect the fixed-term mortgage rates (thus far), this has made variable-rate mortgages more enticing.

There will likely be a surge of activity in the Spring market as there traditionally is an uptick in activity, but this will be coupled with some media coverage of lower interest rates and buyer desire. We will likely start to see some more multiple offer situations some spring, which may cause a slight increase in prices as when competition happens, prices rise.

If you would like to have some real world advice on how to navigate the current market conditions and plan for the future call or text me at 604-522-4777 or email directly at: haze@hazerealty.com or join us on Facebook at www.facebook.com/HazeRealty and we can work out what the lay of the land looks like, so you can make your most educated decision.